Award-winning PDF software

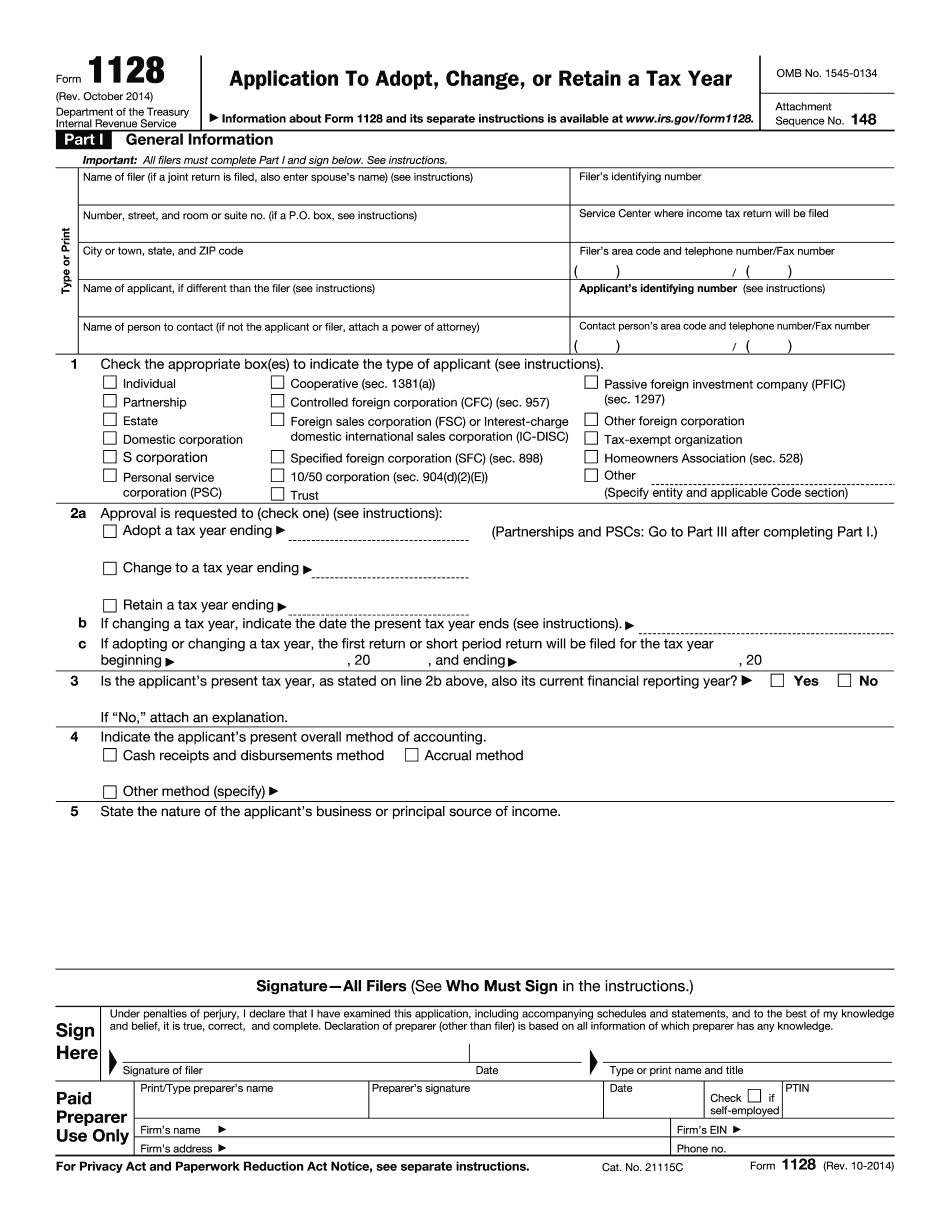

Joliet Illinois online Form 1128: What You Should Know

Download forms, select the proper online payment method, input the required information, and enter the Credit Card Authorization Number or PIN on the City's Tax Portal. When using your credit card or checking account: • When you enter a tax rate of 0.25%, you'll be charged an additional 1.00 in sales tax. • Enter your local assessor's office's telephone number, including area code and area code plus your ZIP code. • Enter the address to which you would like your payment returned. The total amount due on your purchase or taxes paid by credit card or checking account will be charged to the payment method you selected. You will be able to review the credit card charge summary using the payment information you entered on the City's Tax Portal. If you paid your taxes by credit card, you must wait 24 hours after you enter your credit card information to complete your online payment. Payment of Taxes by Mail The City of Joliet must pay the taxes on or before the last day of the month after the date of the most recent registration. City residents must complete and return the following forms and return them to the Joliet Clerk of Court in order to be paid within 45 days of registration: 1. The application for registration form, to be mailed to the city. 2. A valid photo I-94. 3. Proof to establish that you are over the age of 17 years. If you don't need to obtain proof and your family members are also 16 and 65 years old, you will have to submit an affidavit stating that your family members are unable to vote because of age or disability. 4. Proof of residence/address change: a. A certified, valid proof of residential address from your landlord or manager. (See “Residence” above.) b. If you reside in a mobile home park, proof from your local manager. 5. Proof of your Illinois residency, if you reside outside the state of Illinois. If you do not return your forms timely, a late fee of 2% of the payment will be charged to the payment method. If your local assessor's office or municipal treasurer issues a receipt stating that taxes are paid on time, the fee for the late payment will be waived. Electronic payment — Online Payment should appear as soon as the application is submitted. There is no need to bring a copy of your I-94 or tax identification cards with you.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Joliet Illinois online Form 1128, keep away from glitches and furnish it inside a timely method:

How to complete a Joliet Illinois online Form 1128?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Joliet Illinois online Form 1128 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Joliet Illinois online Form 1128 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.