Award-winning PDF software

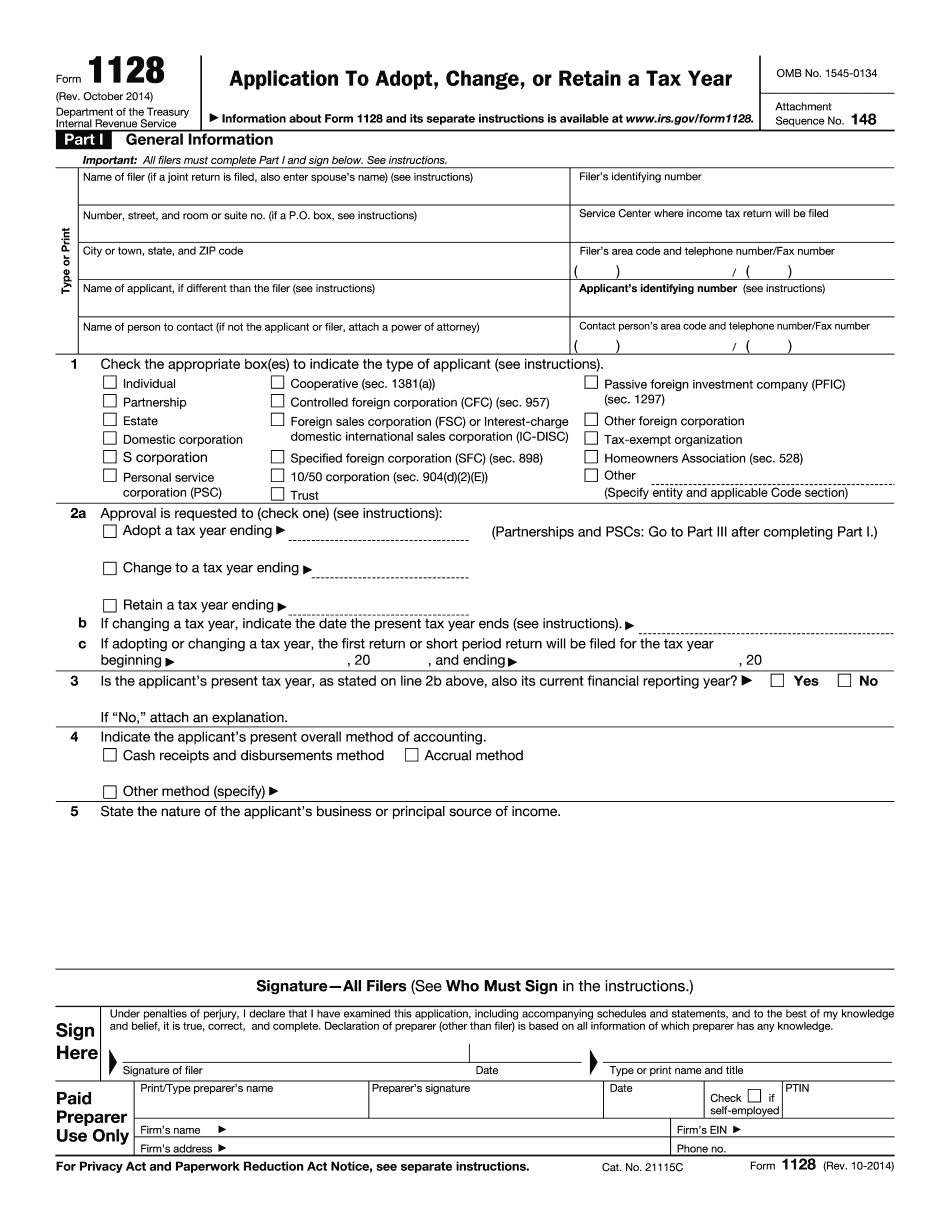

Form 1128 Wilmington North Carolina: What You Should Know

Email Fax Online Contact form North Carolina — State An estimated 1.2 billion is owed to the state and counties of North Carolina, and each year businesses and individuals in this state receive more than 2 million a day in federal and state sales and use taxes. North Carolina also receives nearly 90 million in property management taxes to provide services to the residents. North Carolina property managers and landlords are subject to annual reporting to the federal Bureau of Land Management and to the State General Assembly annually about property taxes, rent collection, services provided and property management payments. North Carolina's tax laws are relatively easy to understand. North Carolina's General Assembly passed and Gov. Pat McCrory signed Act 787 to make the state's sales tax laws more consistent, and to eliminate the State Lottery's monopoly. Since 1998, the General Assembly has revised the State Lottery Board's constitution to end its monopoly and to guarantee fair competition among lottery players. Sales taxes are collected mainly at the retail level as customers browse through their local stores. If a taxpayer purchases a product at the grocery store, the store's sales taxes are paid by the manufacturer or seller. If a taxpayer purchases something at the hardware store, the hardware store collects the State's general sales tax. When the General Assembly passed Act 787, the Board's constitution was changed to require it to collect and remit retail sales taxes. This new law requires most businesses collecting sales and use taxes to be registered with the State Department of Revenue, and to notify the state Department of Revenue if they plan to take a tax deduction. A business should also notify the state Department of Revenue if it would like to take a credit for the sale of services, goods or property, or if it wants to take an excise tax credit. The law provides for the issuance of a refund for refunds of taxes not collected or paid, or of taxes paid but which have been returned because of an administrative error. The State Department of Revenue is responsible for collecting and reporting on, and auditing and reviewing, the refunds made pursuant to this law. To report on a refund filed with the State Department of Revenue, go to, and on a refund filed by a business you must enter the type of business (e.g., retailer, grocery, hardware, etc.), the taxpayer's name and address, as well as the amount of the refund being reported.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1128 Wilmington North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1128 Wilmington North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1128 Wilmington North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1128 Wilmington North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.