Award-winning PDF software

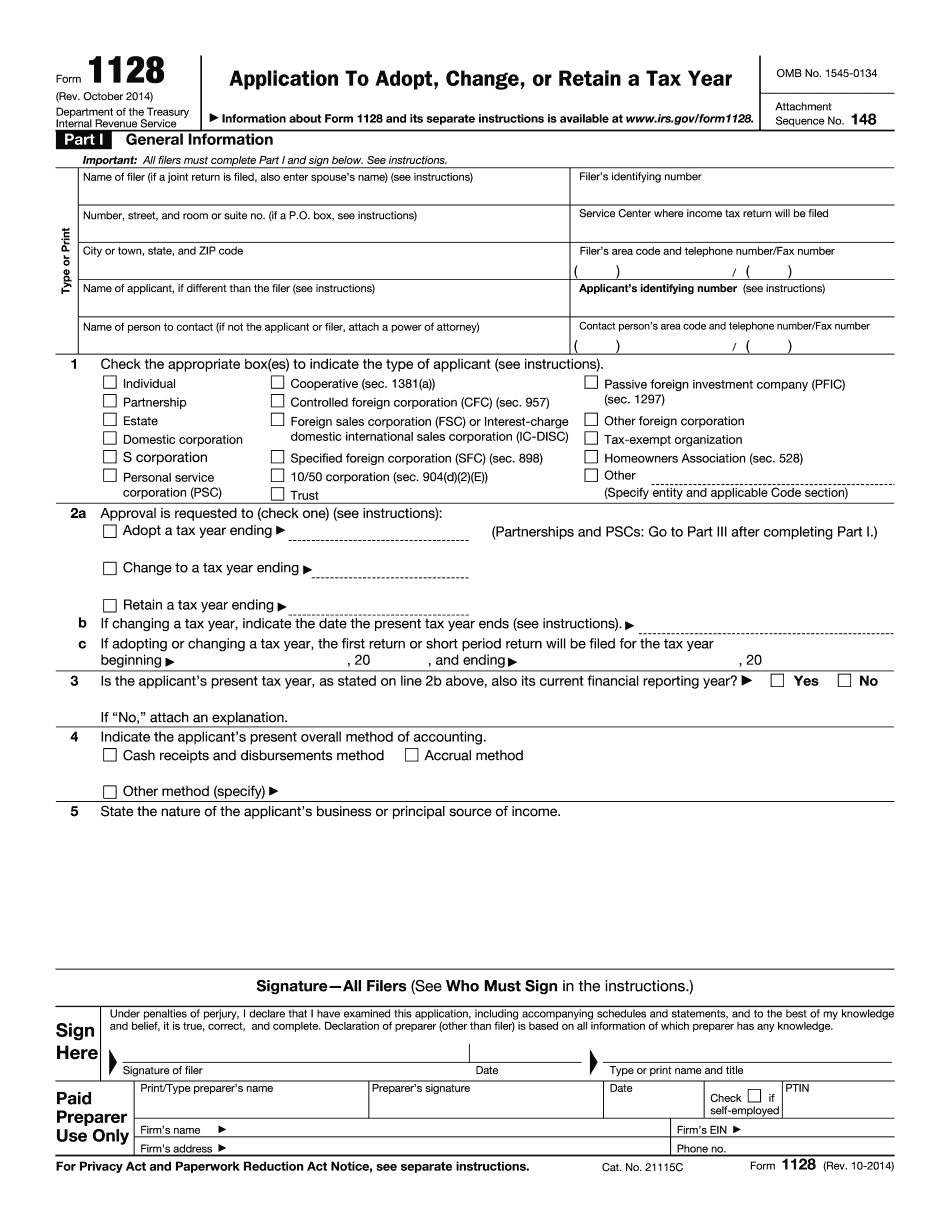

Form 1128 Online Bexar Texas: What You Should Know

Pay online with electronic check by using the Electronic Payment System (EPP). The EPP is a unique credit card payments system designed to allow customers to securely collect their property tax payment online using their credit card or debit card. You may also pay your property tax online anytime, anywhere. Just click on the Pay online link, make a selection, and you should receive a code directly. Complete Form 830 for a confirmation code. How to Apply for Tax Exemptions: Bexar County, Texas For all things Tax Exempt, go to: Bexar County Government Tax Filings | Bexar County, TX — Official Website You may also pay the Bexar County Tax by Mail or Credit Card. Bexar County, TX — County Clerk — Property Tax You can download a Bexar County Property Tax Guide PDF. To be eligible for tax exemption, qualified exempt organizations must prove that they provide quality education, medical, housing and social services, and other important government programs to their communities. The purpose of the County's tax exemption program is to encourage more of those types of tax-exempt organizations to offer free or reduced cost services to their constituents while still maintaining their own fiscal independence and control. For assistance with the Property Tax exemption application, contact the County Tax Clerk's office at: Telephone: Fax: E-Mail: CountyTaxExemptionssbcgov.com You may also download a Free property tax form (PDF) here. Your name, address, and amount of exemption are needed to submit tax-exempt papers. The Bexar County Exemptions office will only receive original (hard copy) copies. No photocopies. The County Tax Exemptions Bureau will not accept electronic copies of the form, and is not responsible for any errors or omissions. Download the County Tax Exemptions application now (PDF). Please Note: A. Information in this section must be provided within 60 calendar days of the effective date of the proposed tax. Your organization must be exempt by the county clerk and/or tax commissioner for the county in which you are doing business. B. You must establish your nonprofit status with the Internal Revenue Service, Federal Insurance Commissioner, Texas Department of Insurance Office of Inspector General, or state board of appraisal. C.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1128 Online Bexar Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1128 Online Bexar Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1128 Online Bexar Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1128 Online Bexar Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.