Award-winning PDF software

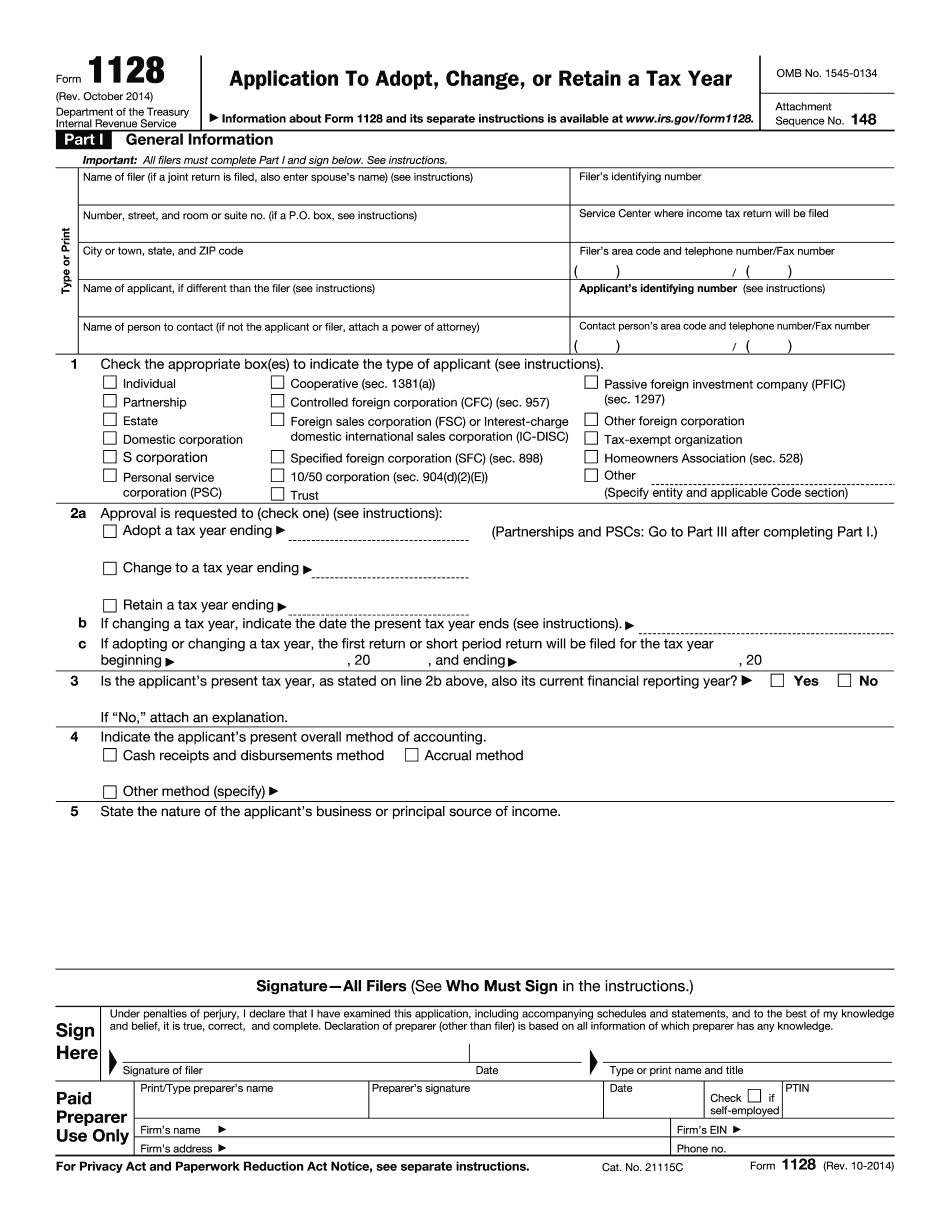

Form 1128 for Tallahassee Florida: What You Should Know

Taxes · Electronic Filing · Employee Taxes · Financial Disclosure · Income Tax Exemptions • Miscellaneous Taxes and Other Publications · Other Forms · Other Publications · Other Publications · Publication on the statewide application for a Florida Driver's License · Publication on the statewide application for an Identification Card · Publication on the statewide application for a Florida Voter Registration Card · Publication on the Florida Department of Agriculture and Consumer Services Tax Exempt and Governmental Organization Exempt Organizations and Individuals Form 5240 (Tax Accountant), and its respective amendments, are available from the Secretary of Taxation's Office of Administrative Support and Customer Services located in the Secretary of State, P.O. Box 800, Tallahassee, Florida 32399-800. Tax accountants, also referred to as tax preparers and accountants, prepare returns, assess tax, file returns, and administer tax-related obligations, including filing requirements, including return certification, and processing claims, including remittance/payment processing. Tax accountants are required to be licensed as Accountants, with a practice and license issued by the state of Florida. Florida may require individuals licensed as accountants to obtain a letter of approval from the Department of Taxation or Florida Taxation Office to carry out their responsibilities. Taxation Office — Finance, Tax, and Administrative Affairs Division, State of Florida Office of Administrative Support and Customer Services, P.O. Box 803 Tallahassee, Florida, 32 Telephone: Tax Accountant (F. A. C. 434.09-11) — Office of Administrative Support and Customer Services Audit, Certification, and Tax Filing Requirements Florida Department of Revenue (FOR) audits and certifies tax returns. Individuals who prepare or receive returns for personal use must report their personal income, sales, and rental property taxes on their return on filing. Individuals who prepare or receive returns for business use or who receive sales and rental property taxes on their return on filing must report the tax and remit the taxes to the Florida Department of Revenue (FOR), and remit the business return to the Florida Dept. of Revenue (FOR), upon request. Individuals who receive the returns electronically must report/file them by the electronic filing deadline. Additionally, FOR reviews and certifies other fees and assessments on returns. Form 740 — U.S. Individual Income Tax Return This form must be filled out fully.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1128 for Tallahassee Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1128 for Tallahassee Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1128 for Tallahassee Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1128 for Tallahassee Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.