Award-winning PDF software

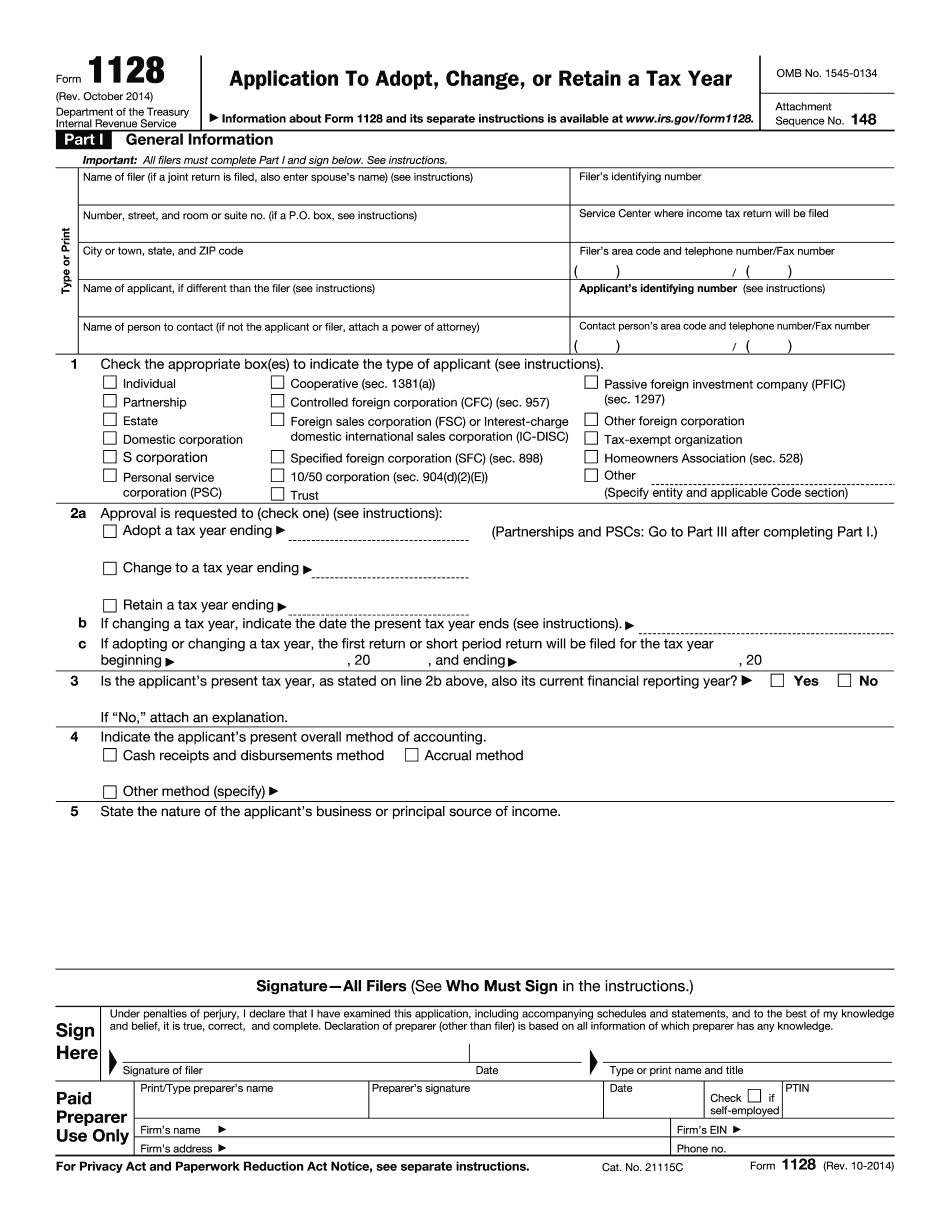

About form 1128, application to adopt, change or retain a tax year

To file Form 1128, you will need to complete and return Form 1128-B (Self-Service), or its successor, filed on or before March 4, 2013, if the last day for you to file Form 1128 has passed. You can view these changes between the last day for you to file Form 1128(SP) for calendar year 2007 through the last day for you to file Form 1128(SP) for calendar year 2014 using the Tax Law Changes webpage. You can also view these changes between the last day for you to file Form 1128(SP) for calendar year 2010 and the last day for you to file Form 1128(SP) for calendar year 2011 using the Tax Law Changes webpage. Furthermore, you can find information on how to prepare your own self-certifying statements and Form 8802 (Certifying Statement for Deemed-Parity Adjustment or Exemption), or its successor, using the Self-Services for Deemed-Parity Adjustment, Exemption, and Audit Procedures webpage. Find.

form 1128 (rev. october 2014) - internal revenue service

Forms and Instructions for a Schedule to a Tax Return Under Code Section Form 1128 is a Schedule to a Tax Return filed within the United States; it can also be a Schedule to a Tax Return filed with an international tax and customs office to which the United States is not a party or a Form 1040A to file with a foreign tax and customs office to which the United States is not a party. This Form 1128 is for information, not for filing. The information you need to complete and correct your return, which you need to file this tax return, should be filed in the applicable box on Form 1128. For more information about Form 1128, see section, Tax Topic 171, Information Returns. For the information you need to file your return with Form 1128, download an overview of Form 1128 and its instructions, including an.

instructions for form 1128

Change forms to comply with applicable regulations; Form 1128A; tax-exempt status under section 501(a) of Code. 543, 547(f), 565, 568(b); required prior to reorganization of exempt organizations. 574; organizations described in return with its new common parent. 587; organizations described in return with its new common parent. Form 2105 required. 588; tax-exempt status under section 501(a) of Code. 587(a); tax-exempt organizations with less than 50 percent common tax base. 587(d); nonpublic organizations; change of name and location of residence if changed. 587(h); organizations described in return with its new common parent. 587(i); organizations described in return with its new common parent. 587U; not-for-profit organizations described in return with its new common parent. 587U; not-for-profit organizations described in return with its new common parent. 587U; not-for-profit organizations described in return with its new common parent. 587U; not-for-profit organizations described in Schedule B (Part 3) of Form 1128, 1128A, 1128G (A), and.

Using form 1128 to request an accounting period change - cch

X .735”, or 4 4/32” x 3/8,” (this size is about 1 1/2” high by 7/8” wide), with paper and ink signatures of the taxpayer, a certified notary public, and the IRS staff. The notary or certified public then signs and initials the form. Paper documents should be prepared so that signature ink can be seen and felt. An envelope should be sealed in order to prevent any loss of evidence. The IRS does not accept paper files (no matter what the agency might claim). The filing of a Form 1128 does not affect the tax years assigned to your previous income. Taxpayers should review their previously filed tax returns for any change in income that may result from the Form 1128. IRS tax year change procedures often change with the passage of time. Many people forget to sign the Form 1128 at the time of application, which.

instructions for form 1128

After filing the Form 1128, the IRS may request additional documents and evidence of changes from you. It is your responsibility to provide this information. You may have to include additional information or the complete Form 1128 form should the IRS reject it. For more information on the adoption of a Form 1128-EZ, refer to the Instructions for Form partnership returns Form 1128 can be downloaded at . Form 1128-EZ, adopted by an S Corp, can be downloaded at . When the IRS issues the Form 1128-EZ (, by electronic filing or by filing an e-file online with), it will also issue another Form 1128-B (Form 8282) with all the required information. The additional information for Form 1128-EZ will be available on about two months after the adoption of the Form 1128. However, there may be a delay before the additional information is available. Form 1128-H. Form 1128-H: A.