Award-winning PDF software

Rev proc 2018-17 Form: What You Should Know

Rev. Pro. 2018-17— (Sec. 301) Limits the liability of a person with respect to a failure to report foreign base company income. Limits the limitation on gross income of a corporation by the basis of dividends and interest paid or accrued by a subsidiary of the corporation. (Sec. 302) Revises the conditions under which a deferred foreign tax credit is allowed for tax paid or accrued from its first taxable year beginning after November 11, 1994, through the latter of (1) the last day of the calendar year in which such taxable year begins, and (2) December 31 if such credit is fully earned by the mayor on the day immediately preceding the date of payment (Sec. 303) Directs the Secretary to require certain taxpayer entities, which are subject to the AMT, to obtain a written statement from the United States with respect to any taxable year in which either (1) the sum of specified foreign base company income or income dividends is less than 200,000, or (2) the combined cost of property for all specified foreign base company income for taxable years beginning during a single taxable year is less than or equal to 200,000. (Sec. 304) Requires the Secretary, pursuant to regulations prescribed by the Secretary, to establish a threshold income level for tax on income of a corporation derived from specified foreign sources. (Sec. 305) Amends the Internal Revenue Code to exempt from the computation of tax under the Internal Revenue Code, a partnership interest equal to the partner's distributive share of profits accruing under a foreign subsidiary (a non-U.S. controlled foreign corporation). (Sec. 306) Revises the meaning of specified foreign earned income for purposes of the special rule for foreign corporations that are not U.S. corporations by extending the application of such income to certain non-U.S. controlled foreign corporations in which the partnership receives no income (and no capital gains), and by making certain related provisions of the Code applicable to such partnerships (Sec. 307) Allows for an election by a taxpayer to reduce or eliminate qualified joint and survivorship gain in a taxable year by the least of the following amounts: (1) the amount by which the taxpayer's adjusted gross income exceeds 200,000 (as adjusted for inflation under Sec.

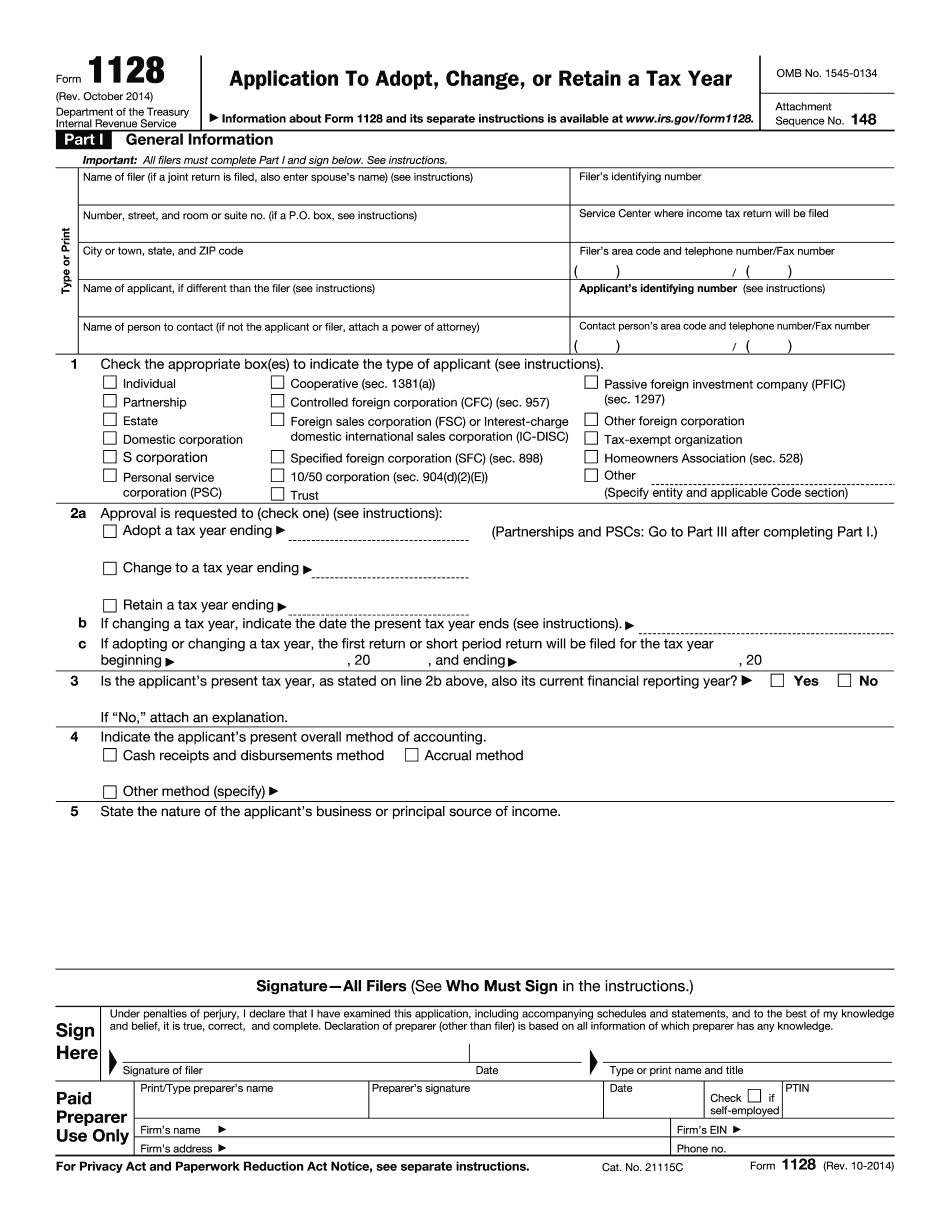

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1128, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1128 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1128 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1128 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.