This video explains the operation of an Excel spreadsheet that is designed to allow delegation of tasks to an assistant and management of those tasks while they are outstanding. The operation of the spreadsheet is explained in the context of lawyers delegating tasks to an assistant, but really it could be used in any context in which tasks need to be delegated. So, the first thing to do is open up Microsoft Excel and make sure macros are enabled because the spreadsheet uses macros. If you need to enable macros, in Excel 2010, you can click File, Options, Trust Center, Trust Center Settings, and then enable macros. Those instructions are also explained on the legal tree page where the spreadsheet can be downloaded from, so you can look up the instructions there if you didn't follow what I just did a moment ago. Okay, so once macros are enabled, you can go ahead and open up the task tracker spreadsheet. When you open up the spreadsheet, you'll see that it basically consists of three main areas. The first is this blue area at the top, which is a task creation area. Tasks are then moved down by clicking this "Move to Outstanding" button. The tasks will then be placed in the outstanding tasks list, which is this orange area over here. Tasks on the list can be manipulated up and down using these buttons. Then, once a particular task is completed, it can be moved down to the completed tasks area in green over here by clicking the "Move to Completed" button. But before a lawyer goes ahead and adds his or her first task, they should make sure that their name is added to the list of lawyers over here. So I'll just add another hypothetical name, and you'll...

Award-winning PDF software

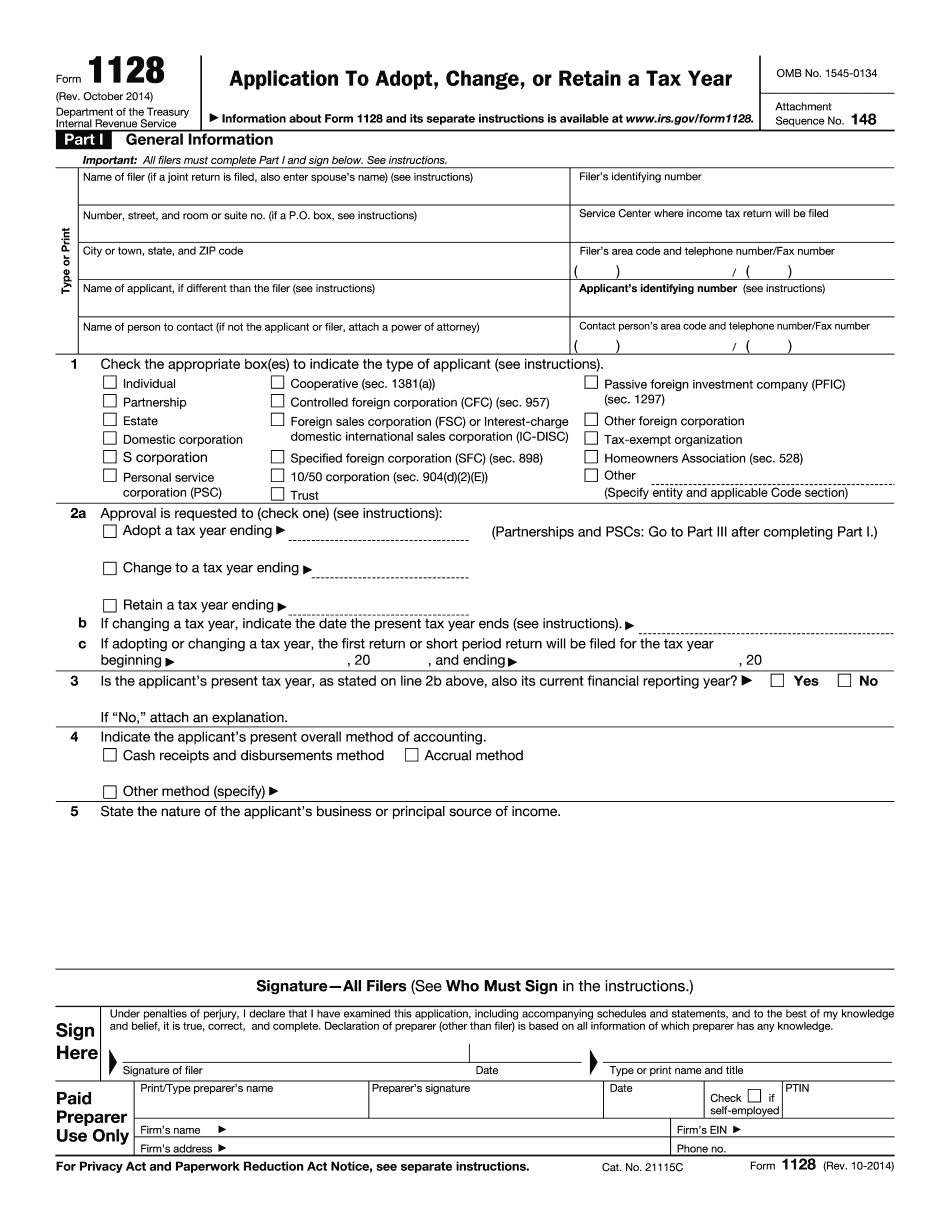

1128 user fee Form: What You Should Know

IRS Raises Fees for Private Letter Rulings Form 1120EZ — IRS Effective December 31, 2016, private letter rulings received with Form 1120EZ and issued as part of a private letter opinion must now be signed by a person authorized to practice law or a legal research firm designated by the person so authorized, or the person signing the form must agree to be subject to the legal research firm's sanctions for improper disclosure of confidential information.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1128, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1128 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1128 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1128 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1128 user fee