Award-winning PDF software

1128 example Form: What You Should Know

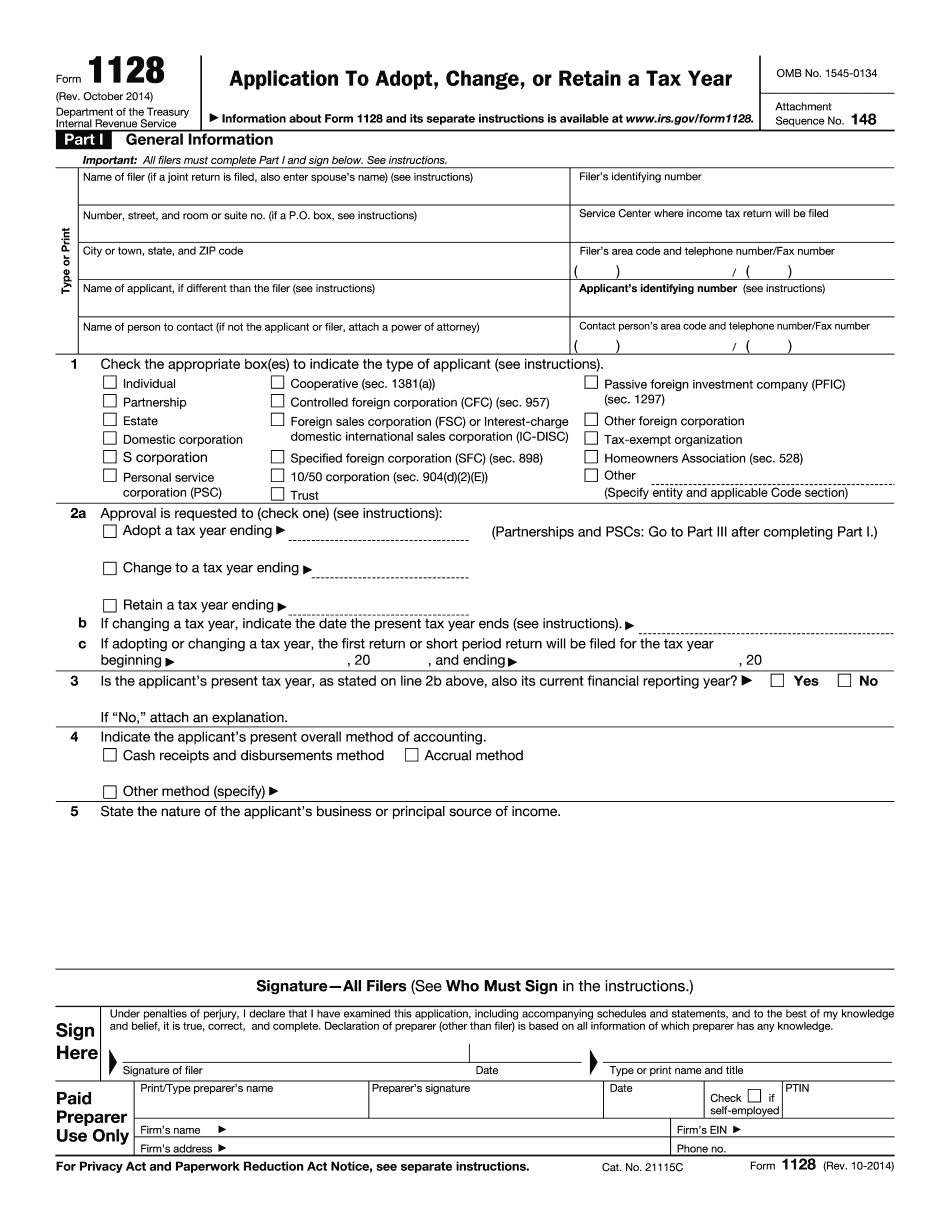

It can be filed up to three annual periods before the year in which the change is to occur. The number of tax years that may have to be changed before one year's tax information is released depends on the length of the prior years' tax years, the total number of tax years involved, and whether an amended return is required by a change in tax year. In the following paragraphs, we focus on the case. Example : A corporation has been making annual returns since 1950. The corporation's stock price has increased by 150% over the years. In the future, the corporation will have to make several adjustments due to new taxes, such as a new 1,000 withholding tax, for each of the four tax years (1952, 1953, 1954, 1955). The corporation wants to use an accounting period change to adopt a tax year that ends in 2025 at the earliest instead of the current tax year. In such a case, Form 1128 is the form to file, as the corporation will need to file Form 1128 for each of the four tax years the amount it would have required to pay the 1,000 withholding tax. Form 1128 contains two parts: Part 1 contains the following information: The corporation's name, address, and the name of the person responsible for the business organization. The Form 1128 application must be filed by anyone who is legally authorized to be the corporation's agent or to represent the trust. Each form will be issued to a designated individual (DIN). The IRS will issue Form 1128, Application to Adopt, Change, or Retain a Tax Year, and for a corporation, Form 1128 (Rev.). Form 1128 (Rev.) contains the following information: The name, address, telephone number, business name and address of an agent or representative of the trust. The corporation and the trust need to be the same entity, in which you can choose to have the trustee appear on the Form 1128, Application to Adopt, Change, or Retain a Tax Year or on the Form 1128 (Rev.). A separate Form 1128 is also needed to change a corporation's tax year from one calendar year to another. You can change a tax year between calendar years. For example, Form 1040, or other IRS forms that deal with tax planning and filing, will not change a tax year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1128, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1128 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1128 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1128 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.