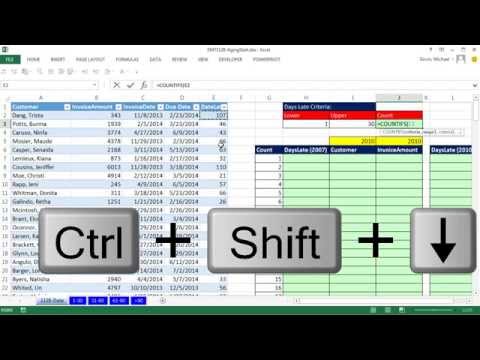

Welcome to Excel magic trick number 1128. Hey, if you want to download these files and follow along, there are two of them: one "1128 Aging Start" and one "1128 Data Source Start". Now, we're going to start by looking at the finished result because we're going to create some accounts receivable reports. Here's our database: customer, amount, invoice date, due date, and number of days late. We need to extract all of the customers with 1 to 30 days late, 31 to 60 days late, 61 to 90 days late, and 91 days and above. So for different reports, we want to create formulas to automatically pull the data from the original data source. Alright, I'm going to close this file and we'll start from the beginning. We have two files, and we'll start with "1128 Data Source Start". This is the file we exported from a database, QuickBooks, or Access. We're going to import this data into the other report workbook, create our formulas, and be good to go. Now, when I get this report each month, I want to convert it to a table here in case we change any of the records so it'll be dynamic. To do this, I'll click on a single cell, go to Table Tools Design, and click "Convert to Table" (keyboard shortcut is Ctrl+T). I'll click OK to create dynamic ranges. Next, I'll name this table "F Aging Table". This is our source workbook with all of our data. I'll save it (Ctrl+S) and close it (Alt+F4). Now, let's import the data. Go to Data, Get External Data, and choose the appropriate extension. Navigate to the file and double click to start the import. It sees the named "F Aging Table" sheet and that's the name I gave the table, so...

Award-winning PDF software

1128 download Form: What You Should Know

Instructions for Form 1128 (Rev. 1st Oct. 2014) — IRS Application Form I-864 for Individuals or Entities to Adopt, Change or Retain a Tax Year in PDF — The Latest Version Of The Instructions Is Applicable For Instructions for the Form I-864 (Application for Change of Name or Address) Instructions for Form 1128, Application to Adopt, Change or Retain a Tax Year (Inst 1128) ‐ Internal Revenue Service (IRS) Instructions for Form 1128, Application to Adopt, Change or Retain a Tax Year (Inst 1128). (Rev.1st Oct. 2014) For individuals and small corporations, the following instructions are a copy of the instructions for people who are applying together for an item or series of items to be adopted, changed, or retained. Use the document for people that are applying together for a change of name or an address. IRS Publication 563 — Changes of Name, Address, or Taxpayer Status IRS Publication 563 — Change of name (refer to Notice 1350, which can also be obtained from the IRS Web page in the area titled Tax Law). IRS Publication 563 — Change of name (refer to Notice 1350, which can also be obtained from the IRS Web page in the area titled Tax Law). IRS Publication 583 — Application to Adopt, Change, or Retain (refer to Notice 1430; or, you can find it by going to IRS.gov from your Internet browser). These are all good places to start if the question that you are having about adopting a child or changing a person's name is related to an adoption or other related request. How to file for an item or series of items to be adopted or changed, or to qualify to retain an earned business income tax deduction, and, where applicable, whether a child needs a change in information, can be found in any or all of the forms listed above. Please note that a person cannot change his or her address. This could be changed in a number of ways, including by changing the address on a Social Security card, in a notice provided by a court order, or by filling out a Notice of Address Change (Form IT-203). These are the same addresses that a person's original federal income tax return was filed in that is shown on Form W-2.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1128, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1128 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1128 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1128 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1128 download