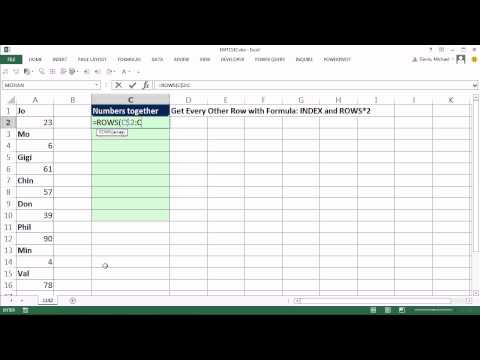

Welcome to XFX trick number 1140. Hey, if you want to download this file and follow along, click on a link below the video. In this video, here we have a lookup formula. But check this out, we have a bad data set instead of like names and sales numbers as field names, and then the names listed in the numbers there every other. And we just simply want a formula that we can copy down however many numbers there are and have it pick up every other cell reference. So one way to do this is to use the index function. So if you look at index, index is a lookup function. And what we're going to do is we're going to give it the array of values. But for the row number, that argument right there, we're going to need to generate the number 2, and then 4, and then 6, etc. So let's look at that pattern first. If we were to use the rows function, we could build a dynamic range that will allow us to create a number sequence 1, 2, 3, 4, 5 as we go down. So I'm sitting in C2, so I'm going to type C$2:$C2. This is an expandable range. Now, what does rows do? Well, it's going to look at rows 2 to 2 and say how many. There's 1. But since that 2 is locked and this one is not, when it gets down to the next row, that 2 will be a 3 and a 4, etc. Control+Enter, drag it down. Now check this out, it does exactly what we thought. The 4 is changing, but the 2 is not in its expandable range right now. Rows is reporting 3 because there are 3 rows in that range. That's...

Award-winning PDF software

How to fill 1128 Form: What You Should Know

Form 1120X (Rev. November 2016) — IRS Internal Revenue Service. Amended U.S. Corporation Income Tax Return. ▷ Information about Form 1120X and its instructions is at. 2021 IL-1120-X — Illinois.gov This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could result in a Form 1120-X — Amended Form 1120 Return. This is the form for the purpose of correcting mistakes made while filing the original income tax return. You will need to send your old return in, not the corrected return. We cannot send your amended return. Please see “Form 1120-X (Rev. November 2016)” above for more information If you received a notice of non-existence from the Illinois Department of Revenue, the filing for Form 1120 or the amended return, you have the option of correcting or amending the return on your own at no additional cost if all the following conditions are met: If the original return (Form 1096) has been filed and all required information was attached when completed, you may file a corrected form without having to be a resident of the state. You may file a corrected form in any state in which you now reside, including any United States or foreign country. You must mail Form 1120 to the Illinois Department of Revenue, Attn: Office of Non-Determination, 601 W. Washington, Suite 1100, Chicago, IL 60. If you have already filed your original return to the Department, and now need to change the filing date, name, address or any other information, you must file your amended return within the 60-day period. You are required to furnish a certification that your amended return is filed, and is true and correct from your point of view. It is recommended that you have this certification mailed to this address. 2028 IN-0140 — Illinois.gov This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could result in a Form 1120-X — Amended Form 1120 Return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1128, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1128 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1128 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1128 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill Form 1128